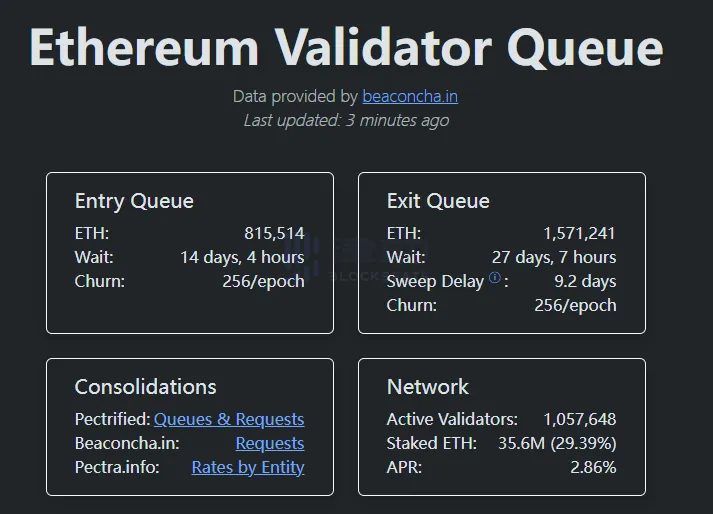

🧐 The number of ETH queuing up to exit the Ethereum PoS network has soared again, now exceeding 1.57 million, is it a bearish signal? Here's a good question: In fact, the surge in Ethereum's exit queue cannot be directly regarded as a single up-and-down signal, but should be viewed in combination with market sentiment, capital flow, and on-chain behavior. In addition to queuing up to exit, there are about 815,514 ETH waiting to join the network, worth about $3.516 billion, indicating that some people are also optimistic about long-term gains. So it is not a unilateral negative signal, but a manifestation of market differentiation: some funds want to cash out, and some funds want to lock up positions for a long time. So how do you see the impact on the market? If the price of ETH exits the queue skyrockets at the same time as large net inflows into exchanges, this is bearish; If the withdrawn ETH mainly flows into Lido, EigenLayer, and DeFi protocols, it is beneficial because it...

Show original

35.46K

17

The content on this page is provided by third parties. Unless otherwise stated, OKX is not the author of the cited article(s) and does not claim any copyright in the materials. The content is provided for informational purposes only and does not represent the views of OKX. It is not intended to be an endorsement of any kind and should not be considered investment advice or a solicitation to buy or sell digital assets. To the extent generative AI is utilized to provide summaries or other information, such AI generated content may be inaccurate or inconsistent. Please read the linked article for more details and information. OKX is not responsible for content hosted on third party sites. Digital asset holdings, including stablecoins and NFTs, involve a high degree of risk and can fluctuate greatly. You should carefully consider whether trading or holding digital assets is suitable for you in light of your financial condition.